By Pius Mordi

Margaret Thatcher, the late Conservative British Prime Minister, was the archetype exponent of private sector-led management of economies. Against the rigid position of organised labour which believed in state running the commanding heights of the economy, she drove a privatisation process that was not only successful but also caged the enormous powers and influence of labour. In fact, she crushed the labour unions.

After extensive privatisation of the public sector during Thatcher’s administration, there remained few statutory corporations in the UK. By the time she was done with the privatisation programme in the 1980s, notable organisations affected included the Central Electricity Generating Board, British Rail, and even Royal Mail.

Yet, she was reported to have made the oft quoted statement that “no nation ever grew more prosperous by taxing its citizens beyond their capacity to pay.” It was a market driven economy with not just a human face but a practical and logical approach.

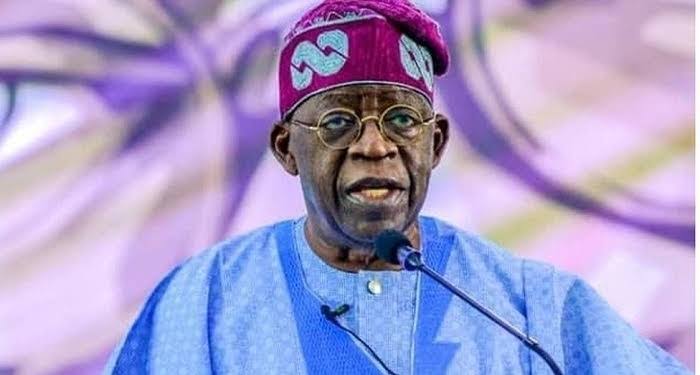

Shortly after the knee jerk announcement of the removal fuel subsidy in his inaugural speech, President Bola Ahmed Tinubu effected what he called the floating of the naira. The combination of overnight massive hike in the price of Premium Motor Spirit (petrol) and tanking of the value of the local currency triggered an unprecedented inflationary trend that some observers insist the inflation is out of synch with the market.

To be fair to Tinubu, he never really articulated his economic policy to Nigerians in the lead up to the presidential election apart from the promise to end fuel subsidy. After the former President Muhammadu Buhari’s regime of borrowing to spend to sustain his officials’ lavish lifestyle, majority of Nigerians had bought into the end subsidy payments mantra. But nobody envisaged the sudden and planless approach Tinubu adopted. The high cost of governance and maintenance of the convoluted bureaucratic machinery is what Nigerians expected to be addressed. Every year, more than 60 percent of yearly budget goes for recurrent expenditure fueled by the high ostentatious lifestyle of top political officials in both the executive and legislative branches.

From borrowing to spend that characterised Buhari’s administration, Tinubu ordered more cheque books as he took over last May. His first budget, a supplementary budget of N2.17 trillion increased the 2023 expenditure profile to N28.17 trillion. It was devoted to acquiring luxury items and embaking on grandoise projects. The office of the First Lady which has no place in the constitution was allocated N1.9 billion for the acquisition of SUVs!

Similarly, the federal government earmarked N2.9 billion for the purchase of SUV vehicles for the replacement of “operational pool vehicles”. The quest for luxury living for the new occupants of Aso Rock saw the setting aside of N4 billion for the renovation of residential quarters for the president as well as N2.5 billion for upgrade of Aguda House, the official residence of the vice president.

The spending spree included N200 million for the “computerisation and digtalisation of the State House”, construction of office complex within State House at N4 billion,

renovation of Dodan Barracks, official Lagos residence of the president and a corresponding N4 billion for the renovation of official quarters of vice president also in Lagos. The list of projects to provide luxury for top Aso Rock officials is endless.

The most unimaginative demonstration of the rabid distribution of the people’s common wealth by a few came from Godswill Akpabjo, Senate President on August 9, 2023 when announcing a month long holiday for the senate after they had sat for barely two months after their inauguration. “In order to allow you to enjoy your holiday, the Senate President has sent prayers to your mailboxes to assist you to go on a safe journey and return,” Akpabio announced to his embarrassed colleagues to correct his earlier gaffe on live television that money had been paid to them for the adjournment of plenary.

The 300 percent increase in tariff for public power supply coming at a time food inflation had risen to 40 percent and general inflation at a new record 33 percent finally jolted organised labour, civil society and students out of lethargy. Unfortunately, the Tinubu administration seems to have lost touch with the crippling poverty in the country and still considered introducing new taxes and enforcement of previously dormant ones. In a memo, the Central Bank of Nigeria (CBN) ordered all commercial banks to impose a 0.5 percent levy on some electronic transactions. The fund is supposed to be transmitted to the Office of the National Security Adviser for the purpose of cyber security. Invariably, ONSA has become a revenue generating agency!

The Cybersecurity Levy came against the backdrop of a muted proposition to further increase Value Added Tax (VAT) from the present 7.5 percent to a minimum of 10 percent. In fact, the presidential committee on fiscal policy and tax reforms led by Taiwo Oyedele proposed 15 percent as the new rate saying there is a need for the increase to enable the federal government fund its fiscal deficit and debt service obligations.

All the new taxes and increase are being effected at a time the minimum wage remains N30,000 with Abuja hedging in reaching agreement with the Nigeria Labour Congress (NLC) and Trade Union Congress (TUC) on a new minimum wage, high food inflation and general inflation that keeps breaking new grounds. The fixation with generating revenue through the taxing of the people beyond their capacity to pay has triggered a chain reaction of poverty, hunger and abysmal purchasing power. The warehouses of the beleaguered real sector are bristling with unsold goods while production capacity for those still staying in business has dropped to less than 30 percent. Others have quietly opted to relocate to other climes with a more conducive ambience for business.

It is no rocket science to agree with Margaret Thatcher that people cannot be taxed beyond their capacity. That is the point Nigeria is in now.

Without a vibrant population with limited capacity to generate disposable income, the poverty level will only deepen. I am not sure acceding to labour proposal of N600,000 minimum wage, a very shot, can change anything. Afterall, how many people are engaged in the public sector and productive private organisations? In the absence of a paradigm shift from taxing to spend to wealth creation, something will have to give sooner than later.

Postscript

The other side of pension

At a recent event in one of the federal universities, a lecturer warned of the impact the uncertainty surrounding pension administration is having on the integrity of the university system. The poverty that comes with retirement due to poor pension and the mode of payment of benefits is compelling lecturers to circumvent the system, he said.

According to him, lecturers and other workers are inclined to corrupt the system in other to ensure a better future for themselves after retirement.

“The best way to guarantee a better future is to venture into politics. But how many can do that comfortably? The scourge of age falsification and corruption of public service will deepen as things get tougher”, he warned. To him, what is going on among politicians and the political class is a recipe other people are bidding to copy.

The scepter of multidimensional poverty is sparing no sector of the Nigerian society.