Billionaire Tony Elumelu, has a net worth of $2.15bn according to MoneyCentral’s analysis of stakes in various companies controlled by him, which have seen record growth in recent years.

MoneyCentral estimated Mr. Elumelu’s net worth as of March 10, 2025, by piecing together his stakes in companies, primarily through his family-owned investment vehicle, Heirs Holdings, and his direct and indirect holdings in publicly traded entities like Transnational Corporation of Nigeria (Transcorp) and United Bank for Africa (UBA).

Heirs Holdings investment portfolio spans the power, energy, financial services, hospitality, real estate, healthcare and technology sectors, operating in twenty-four countries worldwide.

It is inspired by Africapitalism, the belief by Tony O. Elumelu, that the private sector is the key enabler of economic and social wealth creation in Africa.

MoneyCentral defines a billionaire as an individual who has a net worth of $1 billion or more. In calculating net worth, we priced the stakes in public companies as of March 10, 2025 and included dividend income paid to that date.

Private companies were valued in several ways, most often by applying price-to-sales and price-earnings ratios of similar public companies. We tried to identify and confirm all potential liabilities; however, we made no assumptions about personal debt.

Moneycentral’s analysis is laid out below.

Publicly Traded Stakes

Transnational Corporation of Nigeria (Transcorp)

Ownership: Elumelu controls a significant stake in Transcorp via HH Capital Limited, Heirs Holdings Limited and personal/family holdings. As of Full Year 2024, his family’s stake (including wife Awele Elumelu) hit 35.93% or 3.652 billion shares per latest financials.

Elumelu’s 2,997,789,337 shares are held indirectly through HH Capital Limited and 68,386,431 shares are held indirectly through Heirs Holdings Limited. A further 68,276,011 are held directly.

A share reconstruction exercise was concluded in 2024, leading to a reduction in the volume of shares held, however the percentage holdings remain the same.

Market Value: Transcorp’s shares have surged from a reconstructed share price of N5.16 in March 2023 to N51 per share on March 10th 2025. Total market capitalization of Transcorp as at Monday March 10th was N523.8 billion.

The 35.93% stake was equivalent to N187.9 billion or $125 million (at N1500/$).

Growth: Transcorp Plc recorded 107% revenue growth to N407.9 billion ($271 million) in 2024, while Full Year profit rose a massive 189.7% to N94 billion ($62.6 million), signaling strength.

The Board of Directors approved and paid an interim dividend of N4,064,799,029.30 or 40 kobo per ordinary share (equivalent of 10 kobo per share pre capital reconstruction). The Board of Directors has proposed N6,097,198,543.95 or 60 kobo per share as final dividend, bringing the total dividend for 2024 to N10,161,997,574 or N1.00 per share.

It is instructive to note that Elumelu and family will be paid N3.65 billion as dividend for 2024.

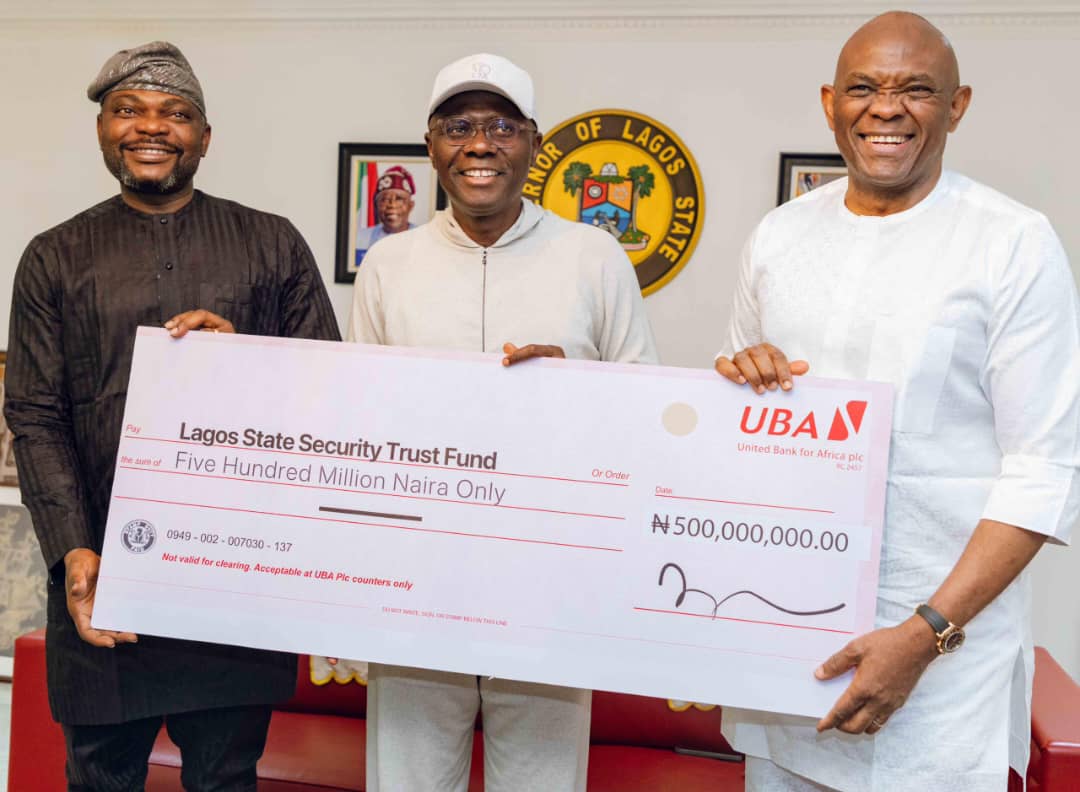

United Bank for Africa (UBA)

Ownership: Mr. Elumelu is the Chairman of United Bank for Africa (UBA) and largest individual shareholder. Data from the 2023 financial statement (2024 numbers are awaited) shows that Elumelu owns a 7.43% stake in UBA.

UBA has 34.2 billion shares outstanding, with Elumelu’s shares comprising 2.3467 billion indirect shares owned through Heirs Holdings Limited (1.814 billion shares), HH Capital Limited (302.29 million shares) and Heirs Alliance Limited (231 million shares) plus 195.12 million direct shares.

Market Value: UBA’s share price hit N37.60 in March 10, 2025 trading, up from N23 per share a year ago in March in 2023.

UBA Chart

Source: Bloomberg

UBA’s market capitalisation is N1.286 trillion meaning Elumelu has a stake worth N95.54 billion or $63.69 million (at N1500/$).

Growth: UBA’s gross earnings rose significantly in the 9-months 2024 period by 83.2 per cent to N2.398 trillion up from N1.308 trillion recorded in September 2023.

There was a 20.2 per cent increase in Profit before Tax (PBT) to N603.48 billion from N502.09 billion recorded at the end of the third quarter of 2023, while profit after tax also surged by 16.9 per cent to N525.31 billion from N449.26 billion recorded a year earlier in the period under review.

Full Year 2024 numbers are being awaited but expected to follow the same trajectory as 9-montsh 2024 results.

Key Subsidiaries via Heirs Holdings

Heirs Holdings was founded in 2010 and is Mr Elumelu’s private investment engine and wholly family-owned (likely held via trusts or direct shares). It controls stakes across sectors and here’s the big ones:

Transcorp Power

Ownership: A Transcorp subsidiary, 50% owned by the group. Mr Elumelu’s 35.93% stake in Transcorp flows through here indirectly.

Value: Transcorp Power has a market captalisation of N2.73 trillion ($1.82 billion) as at March 10, 2025.

Elumelu’s share via Transcorp’s 36% is $653 million, however due to the classic conglomerate discount this is already baked into the Transcorp PLC’s valuation so there will be no double-counting by us.

MoneyCentral will include this in the Net worth of Mr. Elumelu in the future if personal or family owned stakes are revealed apart from ownership stakes through Transcorp PLC.

Growth: Transcorp Power is growing so fast that analysts are struggling to catch up. Transcorp Power reported a 115% increase in revenue to N305.9 billion for 2024, equivalent to 61 percent of its 2031 revenue targets being achieved last year with six more years still left (2025 – 2031) in the forecast period.

Profit after tax surged by 165% to N80 billion in Full Year (FY) 2024, from N30.2 billion in FY 2023.

Transcorp Hotels Plc

Ownership: This is another major subsidiary that is 76% owned by Transcorp Plc. It owns the flagship Transcorp Hilton Abuja.

Value: Same as Transcorp Power there will be no double counting through Transcorp Hotels when determining Mr. Elumelu’s net worth. However, Transcorp’s hospitality arm has a market capitalization of N1.292 trillion or $861 million.

Growth: Transcorp Hotels delivered 69% revenue growth to N70.134 billion in Full Year 2024, while profit after tax rose 138% to N14.895 billion.

As the major subsidiaries (Transcorp Power and Transcorp Hotels) continue to grow it will be reflected in the valuation of the parent Transcorp Plc and as such increase Mr. Elumelu’s net worth.

Heirs Energies (formerly Heirs Oil & Gas)

Ownership: Heirs Energies has demonstrated remarkable operational excellence since acquiring the OML 17 block in July 2021. Within just 100 days of taking over operations, the company doubled its oil production from 27,000 to 52,000 barrels per day.

The asset is 100% Heirs Holdings-owned which bought 45% of OML 17 for $1.1 billion in 2021 with Transcorp (Energy Capital Power). Heirs Energies is the sole operator of OML 17, in Nigeria’s Niger Delta.

Market Value: The asset (OML 17’s) output of 52,000 bpd with 2P reserves of 1.2 billion boe, and an additional 1 billion boe resources of further exploration potential and gas assets, suggest a $1.5-$2 billion valuation in 2025.

With Brent oil at $70/per barrel, Seplat a comparable indigenous oil producer with 52,947 barrels of oil equivalents per day (BOEPD) in 2024 had a market capitalization of $2.23 billion or N3.35 trillion as at March 10 2025.

We would value Mr. Elumelu’s full Heirs Energies stake through control of Heirs Holding, the owners of the asset at $2 billion, dropping to $1.75 billion due to potential profit split with Transcorp PLC.

Heirs Insurance Group (Heirs Insurance, Heirs Life Assurance)

Ownership: 100% Heirs Holdings.

Growth: Nigeria’s insurance market is small with about N1.5 trillion ($1 billion) in gross premiums in 2024. Heirs Group’s General and Life companies, combined, recorded a 59.30% increase in Gross Written Premium (GWP), rising from N19.9 billion in 2022 to N31.7 billion, for the year ending December 31, 2023, as they both enter their fourth year of operations.

In addition, the Group’s earned insurance revenue for year 2023 stood at N20.5 billion, a surge of 80% from N11.3 billion in 2022, reaffirming the Group as one of the fastest-growing insurance groups in Nigeria.

Value: The firm could garner a valuation of 2 times sales comparable to AXA Mansard Insurance.

This would value it at N42 billion or $28 million (2x revenue, per solid growth and industry norms). Mr. Elumelu’s full stake would then be also equivalent to $28 million.

United Capital Plc

Ownership: Heirs Holdings has a stake (the size is unclear, but we estimate at possibly 25%).

Growth: United Capital’s after tax profit surged by 111% to N24.1 billion from N11.4billion in 2023. In respect of the current year, the Directors propose that a final dividend of N0.50 kobo per ordinary share of 50 kobo each amounting to N9.0 Billion, be paid to shareholders upon approval at the Annual General Meeting.

Value: United Capital has a market capitalsation of N369 billion or $246 million as at March 10 2025. A 25% stake means Mr. Elumelu’s Net Worth would be valued at $61.5 million.

Other Assets used in calculating Mr. Elumelu’s Net Worth

Real Estate: Mr. Elumelu owns “extensive” Nigerian property (Forbes, 2024). There are no specifics, so we assign a $75 million conservative estimate for a billionaire’s portfolio.

Cash & Investments: Mr. Elumelu has got liquid assets especially with major dividends coming from all his investments. We estimate cash holdings at $50 million likely, per billionaire norms.

Philanthropy

Heirs Holdings is inspired by Africapitalism, the belief of the Chairman, Tony O. Elumelu, CFR that the private sector is the key enabler of economic and social wealth creation in Africa.

Driven by this philosophy, Heirs invest for the long-term, bringing strategic capital, sector expertise, a track record of business turnaround success and operational excellence to companies they invest in.

Mr. Elumelu’s philanthropic Foundation catalyses entrepreneurship across Africa, through the USD $100million Tony Elumelu Foundation Entrepreneurship Programme, advocacy and research.

Bottomline: Tony Elumelu’s Total Net Worth Estimate is $2.15 billion

Source of wealth

Source: MoneyCentral