The Nigerian Communications Commission (NCC) has disclosed how telecoms service tariffs and rates are determined for mobile network providers in the country.

TheNewsGuru.com (TNG) reports Executive Vice-Chairman (EVC) of NCC, Dr Aminu Maida made the disclosure during an interactive session with technology reporters in Abuja on Thursday.

Dr Maida disclosed that telecoms service rates are determined through comprehensive cost study to analyse the actual costs of providing a service.

Maida said the NCC played a crucial role in regulating the telecom sector, ensuring that rates charged by service providers were fair and cost-oriented.

“Rates were not simply pulled out of thin air. Instead, the commission conducts a comprehensive cost study to analyse the actual costs of providing a service,” he said.

According to him, by analysing these costs, the commission can determine a fair and reasonable rate for services such as USSD charges.

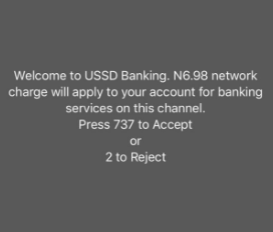

“You are asking about the rates, specifically the N6.98 Unstructured Supplementary Service Data (USSD) deduction from airtime recharge. Where did we get this figure from? Did we just pull it out of thin air?

“What we normally do at NCC is conduct a cost study before allowing anyone to charge a particular rate. This means we analyse how much it costs to provide the service.

“We have done this for USSD charges and are currently conducting a comprehensive cost study. Once completed, we will issue a determination based on all relevant factors.

“This approach ensures that charges imposed are based on real costs, rather than arbitrary figures,” he said.

He said that the NCC’s cost study considered various factors, including the cost of infrastructure, maintenance, and personnel.

The EVC said that the telecom sector, which was liberalised, ensured that any charge or rates imposed were cost-oriented.

“Consumers may not directly participate in rate determination discussions, the NCC protects their interests by scrutinising the costs and justifications behind service providers’ proposed rates.

“For instance, if a provider wants to charge a certain rate for calls, they must justify the cost breakdown to us. This ensures that rates are fair and based on actual costs.

“The level of expertise required for these discussions makes it challenging for ordinary consumers to participate directly,” he said.

The clarification is coming after NCC directed deposit money banks to stop deducting charges for USSD transactions directly from customers’ accounts.