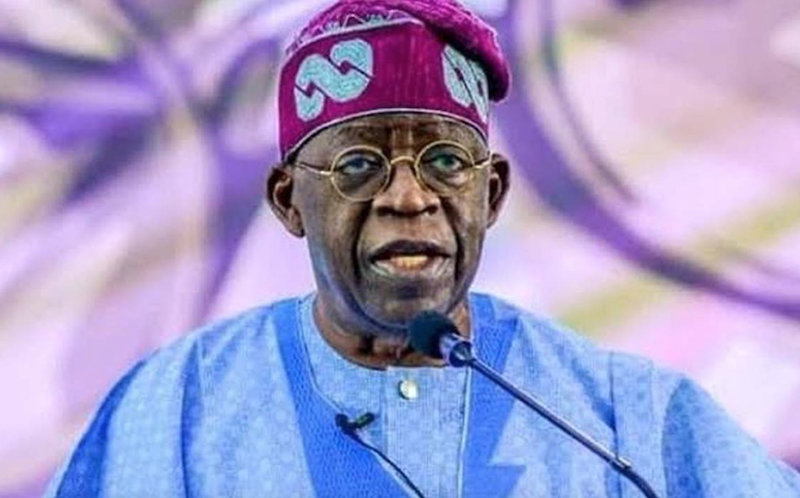

When Wale Edun, President Bola Tinubu’s Finance Minister, announced that $20 billion has been saved since the scrapping of the fuel subsidy regime, he may have expected Nigerias would be elated and applaud the administration. Rather, there is consternation on the propriety of the claim. Proclaiming that removal of fuel subsidy had recorded a tremendous success as to plough a whopping amount into the national treasury is confounding againstthe backdrop of worsening state of the economy. And with the impressive return from the revenue generating agencies, Edun’s claim became a tough sell.

If there is $20 billion in the vault of the Central Bank of Nigeria (CBN), why is it not reflecting on the strength of the naira in the foreign exchange market. More importantly, where is the money and what has it been used to do?

From making the disclosure at an event in Abuja to mark the first 100 days in office of Mrs. Didi Esther Walson-Jack, Edun doubled down on his claim when he appeared before Senate Joint Committees on Finance and National Planning and Economic Affairs on the 2025-2027 Medium-Term Expenditure Framework/Fiscal Strategy Paper. He did not just defend the president’s request for approval to borrow additional $2.2 billion, but said the country needs to borrow more. Despite the huge debt overhang inherited from former President Muhammadu Buhari, Tinubu has the luxury of a compliant National Assembly with a garrulous Godswill Akpabio presiding.

Unfortunately, the people do not have the corresponding luxury of a leader of lawmakers with the desire to seek explanations for the people. If only we had Senate President in the mould of Bukola Saraki! Just like his predecessor, Ahmed Ibrahim Lawan, who declared from day one that his job is to ensure anything Buhari asks of the Senate, Buhari gets, Akpabio did not need to make such declaration. A few days after his emergence as leader of the legislative arm of government, he gleefully attended an official ceremony with the insignia of Tinubu emblazoned on his cap. Of course, Tinubu himself was on hand to regale in Akpabio’s powerful statement.

Even though Akpabio and his team were committed to giving Tinubu whatever he wants, they could have put up the semblance of a show akin to window dressing and still give their approval. Whenever issues that raise eyebrows come, Aso Rock resorts to sloganeering. The precursor to the loan application was Edun’s explanation on how it was determined that the removal of fuel subsidy saved over $20 billion.

“An amount of five percent of GDP is what those two subsidies were costing,” Edun stated. “When there was a subsidy on PMS and on foreign exchange, they collectively cost five percent of GDP. Assuming GDP was $400 billion on average, five percent of that is $20 billion—funds that could now go into infrastructure, health, social services, and education” he concluded. And a few days afterwards, Tinubu himself unequivocally declared that he will grow the economy from $362 billion to $1 trillion by 2030. Apparently, the statement is to sweeten the loan application as something that will trigger an unimaginable growth in the economy within just six years!

How can that projection(?) be achieved? In the 2024 fiscal year, N9.7 trillion constitute the deficit component of the N35.5 trillion 2024 budget to be funded by borrowing. Invariably, all the loans obtained by Tinubu since he became president have been devoted to funding budgets while personnel costs continue to baloon with multiple level appointments.

Expectations that before approving the loan requests, Akpabio’s Senate would seek explanations on how the funds will be deployed. It is a spectacle that has left Nigerians more confused that relieved that the fuel regime is working. “We still need to borrow productively, effectively and sustainably all in the name to invest in a Nigerian economy”, Edun warned the senators during his session with them. It is a paradox: revenue collection agencies are making more returns; billions of dollars are “saved” from what would have been used to import refined products and payment of subsidies; foreign exchange reserves are rising; yet, the naira keeps losing ground against the dollar. The CBN keeps raising interest rest rate ostensibly to check inflation. But as the naira steadily tumbles in the market, inflation strengthens. Wale Edun has to open the books and tell Nigerians why the people can no longer make ends meet with the waning local currency.

Postscript

*Calling Dave Umahi*

In a few days, December will be here. It is a special season of the year for the southeast. Many people from that part of the country embark on the customary return to their homes and villages for the Yuletide. That annual ritual begins from the first week of December, barely 10 days away.

For over seven months, the major road leading to the East with its newly commissioned second Niger bridge has collapsed in Asaba, capital of Delta State. Its only a four-lane dual carriageway. The huge vehicular traffic on the road has wreaked a lot havoc on the inner city roads in Asaba as heavy duty vehicles join cars in avoid the collapsed federal highway. They were not built for such traffic and are beginning to fail in many sections as well.

Rt. Hon. Sheriff Oborevwori, Governor of Delta State, had deployed his men to repair the collapsed section, but Umahi’s men in the Federal Ministry of Works warned Oborevwori’s men off. The Governor was not bothered that the federal government will uphold its resolve not to refund to states any amount spent on rehabilitating federal roads. He just wanted relief for road users. Federal Works Ministry officials claimed that contract for the rehabilitation of the road has been awarded. Eventually, the contractor did mobilise to site. Barely.

But the pace of work is so frustratingly slow that there will be no relief for travellers this Yuletide. We warned in this column that it has been a nightmare for road users going to the south east and south south. This time, it will be armaggeddon for travellers. That is unless the heart of Dave Umahi and his Works Ministry officials are touched to do the right thing. And save Asaba inner city roads.