France’s priority is to stabilize the Middle East, French Junior Foreign Affairs Minister Amelie de Montchalin said on Friday after a U.S. air strike killed Iran’s Quds Force commander Qassem Soleimani.

“What is happening is what we feared: tensions between the United States and Iran are increasing,” Montchalin told RTL radio. “The priority is to stabilize the region.”

The minister said top French officials would make high-level contacts with senior players in the region.

Iraq’s powerful Shiite Hashd Shaabi militia said on Friday that the group’s deputy leader, Abu Mahdi al-Mohandes, and high-ranking Iranian General Qassem Soleimani have been killed in an attack near Baghdad airport.

The Iran-backed Hashd Shaabi, also known as the Popular Mobilization Forces (PMF), said they were killed in a U.S. strike targeting their vehicle on the Baghdad International Airport road.

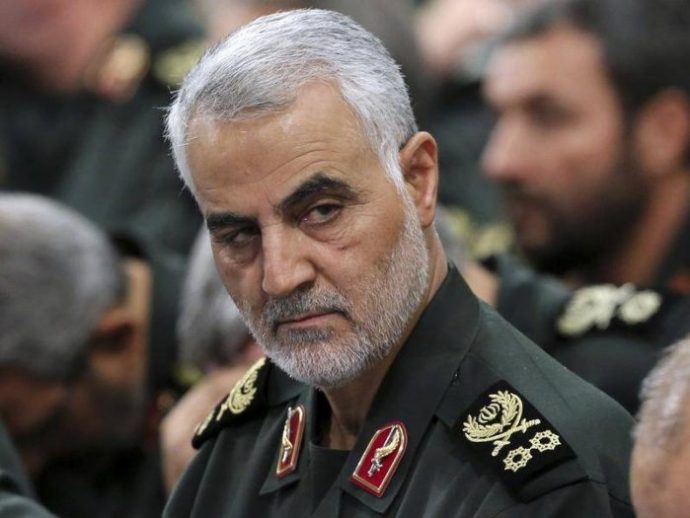

Soleimani is the Commander of Iran’s Quds Force, a unit in the Iranian Revolutionary Guards (IRCG).

Their deaths are the latest escalation in tensions between the U.S. and Iran, coming after thousands of supporters of the Shiite militia broke into the U.S. embassy compound in central Baghdad on Tuesday.

Protesters set fire to one of the gates of walls around the embassy buildings and camped outside until the next day.

The two days of protests were triggered by U.S. strikes in Iraq and Syria on Sunday that targeted the Kataib Hezbollah militia group.

The U.S. airstrikes killed at least 25 militiamen.

Kataib Hezbollah, a part of the Hashd Shaabi umbrella group, had been blamed for an attack last week that killed a US citizen.

Loud explosions were heard near the airport early Friday, which Iraqi security said was three Katyusha rockets falling down in the vicinity killing several people and leaving two vehicles burnt.

Shortly after, the militia said five of its members were killed in the attack, including Mohammed Reda al-Jaberi, who was the group’s head of the public relations and protocol officer.

The U.S. killed Iranian general Qassem Soleimani in a “defensive action,” the Pentagon says.

“At the direction of the President, the U.S. military has taken decisive defensive action to protect U.S. personnel abroad by killing Qassem Soleimani,” the Pentagon statement says.

The Pentagon says Soleimani was “actively developing plans to attack American diplomats and service members in Iraq and throughout the region.”

“General Soleimani also approved the attacks on the U.S. Embassy in Baghdad that took place this week,” the statement continues.

The U.S. also held Soleimani and his Quds Force responsible for the deaths of hundreds of American and coalition service members and said he “orchestrated” a rocket attack on Dec. 27, which killed an American.

Meanwhile, Brent crude futures jumped nearly three dollars on Friday after a U.S. air strike in Baghdad killed top Iranian and Iraqi military commanders, sparking concerns of disruption to Middle East oil supplies.

Brent crude futures LCOc1 hit an intraday high of 69.16 dollars a barrel, their highest since Sept. 17, before easing to 68.42 dollars, up 2.17 dollars or 3.28 per cent by 0806 GMT.

West Texas Intermediate (WTI) crude futures CLc1 were up 1.85 dollar or 3.04 per cent at 63.03 dollars a barrel, having earlier spiked to 63.84 dollars a barrel, their highest since May 1, 2019.

“The supply side risks remain elevated in the Middle East and we could see tensions continue to elevate between the U.S. and Iran-backed militia in Iraq,” said Edward Moya, analyst at brokerage OANDA, in an e-mail to Reuters.

An air strike at the Baghdad International Airport early on Friday killed Iranian Major-General Qassem Soleimani, head of the Quds Force, and Iraqi militia commander Abu Mahdi al-Muhandis, an Iraqi militia spokesman said.

The killings marked an escalation in the regional “shadow war” between Iran and the United States and sparked Iranian calls for revenge and preparation for further conflict in Iraq.

“There is an ever present risk that Iraq would be the theater where the struggle between the U.S. and Iran would play out,” Helima Croft, RBC Capital Markets’ global head of commodity strategy said in a note.

Iraq, the second largest producer among the Organisation of the Petroleum Exporting Countries (OPEC), exports about 3.4 million barrels per day of crude.

In Europe, Belarus on Friday also said Russia had halted oil supplies to its refineries.

Oil prices were also lifted by China’s central bank saying on Wednesday it was cutting the amount of cash that banks must hold in reserve, releasing around 800 billion yuan (115 billion dollars) in funds to shore up the slowing economy.

This came shortly after data showed China’s production continued to grow at a solid pace and business confidence shot up.

“Oil prices still have room for further upside as many analysts are still having to upgrade their demand forecasts to include a rather calm period on the trade front,” Moya said, referring to signs of a thaw in trade relations between China and the U.S.

Also, Asian shares slipped on Friday, erasing early gains, while gold shone and oil prices spiked after U.S. air strikes in Iraq killed a top Iranian commander, heightening geopolitical tensions.

Iranian Maj.-Gen. Qassem Soleimani, head of the elite Quds Force, and top Iraqi militia commander Abu Mahdi al-Muhandis, were killed early on Friday in a U.S. air strike on their convoy at Baghdad airport, prompting Iran’s Supreme Leader Ayatollah Ali Khamenei to vow harsh revenge.

MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS had touched its highest point since June 15, 2018, in early trade, but fell after reports of the air strike emerged. It was last down 0.16 per cent.

European shares were set to follow their Asian counterparts lower.

Pan-region Euro Stoxx 50 futures STXEc1 shed 0.66 per cent to 3,757, German DAX futures FDXc1 were down 0.6 per cent to 13,303.5 and FTSE futures FFIc1 gave up 0.42 per cent to 7,514.

China’s CSI300 index, one of the world’s best-performing indexes last year, struggled to stay in positive territory but was last down about 0.2 per cent.

Australian shares finished up 0.64 per cent, but off earlier highs.

“It remains very unclear exactly what impact (the U.S. strikes) could have on the equity market,” said Tapas Strickland, director of economics and markets at National Australia Bank.

“It is significant that one of Iran’s top military generals was reported to have been taken out … but it all hinges on what Iran does in terms of retaliation,” he said.

Middle Eastern tensions upset a rally for the MSCI index, which finished at its highest close in more than 18 months on Thursday.

It had been lifted by a New Year’s Day announcement from China’s central bank that it would cut the amount of cash that banks must hold as reserves, releasing around 800 billion yuan (114.87 billion dollars).

Against the backdrop of a thaw in trade tensions between the United States and China, global markets had seen renewed appetite for risk assets.

“You have from both a policy and trade perspective a favourable framework for … risk assets for the weeks to come,” said Frank Benzimra, head of Asia equity strategy at Societe Generale in Hong Kong.

“The issue in our view, and that is the central scenario, is beyond these few weeks – where could we see a further correction?” he said, noting that the United States is unlikely to enjoy further fiscal stimulus before the presidential election in November.

Shares had received further support from data on Thursday showing factory activity in China continued to grow at a solid pace in December, and that business confidence improved.

Markets in Japan remain closed for a national holiday. Overnight, Wall Street’s major indexes notched record highs in their first session of the decade.

The Dow Jones Industrial Average .DJI rose 1.16 per cent to 28,868.8.

The SP 500 .SPX gained 0.84 per cent to 3,257.85 and the Nasdaq Composite .IXIC added 1.33 per cent to 9,092.19.

But U.S. stock futures pointed to a grim day on Friday after the air strikes, with SP e-minis ESc1 shedding 0.84 per cent.

U.S. Treasury futures also rose TYc1 reflecting an implied yield of 1.74 per cent.

While equity markets turned lower, oil prices surged on news of Soleimani’s death, which ramped up supply worries as the geopolitical situation deteriorated.

The global benchmark Brent crude LCOc1 shot 2.97 per cent higher to 68.22 dollars per barrel and U.S. West Texas Intermediate crude CLc1 jumped 2.81 per cent to 62.90 dollars per barrel.

The strikes came after U.S. Defense Secretary Mark Esper said on Thursday there were indications Iran or forces it backs may be planning additional attacks after Iranian-backed demonstrators hurled rocks at the U.S. embassy in Baghdad.

In currency markets, the dollar weakened as investors snapped up safe-haven yen. The greenback fell 0.42 per cent against the Japanese currency to 108.11 Japanese yuan.

The dollar was little changed against the euro at 1.1167 dollar.

The dollar index .DXY, which tracks the dollar against a basket of six major rivals, was down 0.04 per cent at 96.808.

The U.S. strikes in Iraq and recent dollar weakness combined to burnish the value of gold, driving the precious metal 0.84 per cent higher on the spot market XAU= to 1,541.73 dollars per ounce, around four-month highs.